It’s not often that I cross The Pennines for business, but following my invitation from KPMG Partner Graham Pearce, I jumped in the car to make my way over to the North West. The new KPMG building in Manchester’s St Peter’s Square is impressive, and it’s the only building worldwide which KPMG shares with other tenants.

The pull of the event was funding for tech businesses, and represented on the panel of guest speakers was TechNorth’s James Bedford, Head of Investment Strategy. I remember mentioning to former Deputy Prime Minster Nick Clegg a few years back they should have Silicon Yard in Hull, Silicon Pit in Sheffield and Silicon Mill in Leeds, and it now looks like one of Nick Clegg’s legacies is happening. TechNorth aims to accelerate the digital economy in the North of England.

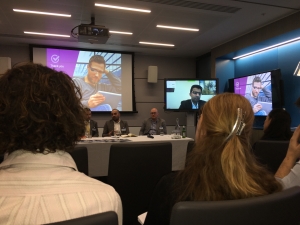

Most of the audience were start ups, and following an introduction via video link from KPMG’s Global Tech Lead Mihir Jobaliaand, a lively debate ensued. One of the annoyances of the startups was the funding gap for early-stage businesses. This was demonstrated by the lack of an early-stage venture capitalist on the panel. A debate around solo vs co-founded businesses then emerged.

It was stated that investors prefer to invest in co-founded businesses rather than sole founders. Perhaps it’s deemed that a solo entrepreneur is more risky. Some people think that if you go solo, the results will be so low. Others think that having a co-founder can increase the risks of disagreements around direction in the early-growth stages.

Bill Enevoldson of GMCA Public Funding (a Greater Manchester organisation), explained how one of their key criteria for funding was job creation for the local economy, and that they had invested £20M in the last 18 months in tech companies in the North. Bill explained the importance of the management team and how, after the first hour of meeting the team, they decide whether to invest. David Parr of Barclays Debt explained a new initiative to make funding available for start up tech firms, with £80m earmarked in the fund, increasing to £200M.

Mo Aneese, of Living Bridge Private Equity, explained how the investment mentality in the UK is very much different to that of the USA. Where failure is generally accepted in the USA, it is frowned upon in the UK. Private equity houses are generally interested in later-stage businesses and expect a x2 or x3 return on their capital compared to the high multiples expected by some US investors. I guess the US investors are prepared to take more risks.

My key question for the evening was, if I was to raise capital, where should I look – the UK or the USA? The audience seemed to think better valuations and risk-appetite would be found Stateside. USA investors seem to be driven more by growth and UK investors want to see bottomline profitability.

If you travel across the M62 and the North of England it is of similar distance to travelling down Silicon Valley from San Francesco to Palo Alto. I guess the only difference is that the M62, the highest motorway in Europe, can be tricky on snowy winters evenings. High speed rail across the North (HS3) might have been pulled but there is always the high speed Internet, and we are all tech companies after-all!

Hopefully, the funding gap for early stage startups will be resolved in the near future and initiatives to allow startups to flourish in the commercial centres of NatWest banks can only be seen as good. Startups don’t just need money, they need “money+” – money plus mentoring and advice.

Finally, for good businesses, money can always be found. Investors are looking for a market opportunity and a back able individual. The evening was a great way to share views and learn more about the tech scene in the North. TechNorth, after all, is about collaboration, and if more connections can be made across the North that can only be a good thing.